As organizations seek to reduce costs and improve efficiency, paper-intensive processes such as accounts payable (AP) invoice processing are likely candidates for automation.

At many companies, accounts payable (AP) processes are still largely manual and paper-intensive. When the volume of invoices increases, these manual procedures start to show their limitations. While some firms have automated portions of the accounts payable process by receiving invoices electronically via electronic data interchange (EDI), typically many manual validation and approval steps remain.

Companies wrestle with the challenges of receiving paper invoices and matching them against purchase orders (POs) and general ledger (GL) coding. Lack of automation ultimately leads to bigger business challenges associated with accruals for financial closing and lack of visibility into corporate spending. Chief financial officers (CFOs) and corporate controllers need visibility into the accounts payable process to improve cash management, simplify reconciliation, streamline accruals, and produce more-accurate financial statements.

The procurement process has evolved from an administrative and record-keeping business unit into a transformative function. Siloed and fragmented systems make the process slow, inefficient and prone to errors. Hence, organizations must optimize the procure-to-pay (P2P) lifecycle while connecting their resources, systems, processes, and people.

The Need for Better Cash Management

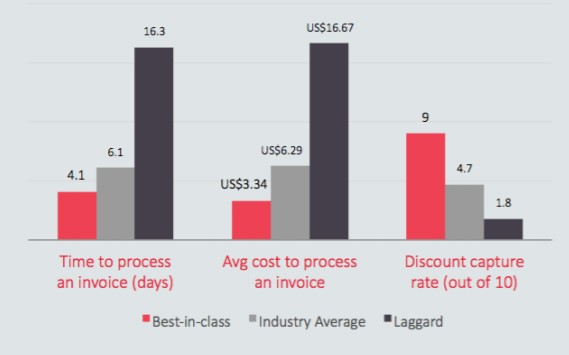

According to Aberdeen Research; a typical AP user can process about 20 invoices per day. Once you consider the loaded cost of these workers, plus ancillary costs for managing the associated manual processes, each invoice costs an average of US$17 and takes about 16 days to process. This is a huge cost for a company receiving hundreds, thousands, or even millions of invoices each year. These statistics from Aberdeen are illustrated below.

Because of the unrelenting workload, many AP users are overburdened and thus prone to making errors during data entry. Invoices “slip through the cracks” in such manual processes. It also becomes difficult to detect related payments. As a result, the AP staff may fall behind, which causes the company to lose opportunities for early payment discounts—or be required to pay late penalties and fees. In addition, manual AP processes often lack long-term storage, retention, and disposal policies mandated by state and federal regulations.

While AP users’ wrestles with manual processes, financial officers don’t get the necessary visibility into corporate spend and hence cannot manage cash effectively. They don’t know the complete extent of corporate liabilities until the invoices are approved and entered into the enterprise systems of record. With so many invoices outstanding and little visibility into their status, getting accurate information about accruals becomes tedious, time-consuming, and difficult.

Assigning more people to handle manual AP processes is not a viable or scalable solution to the problem. To automate AP activities in an orderly way, you need well-engineered business processes that integrate with established information systems such as Oracle E-Business Suite, Oracle’s JD Edwards, SAP R/3, SAP Business One, Microsoft Dynamics 365, and Infor.

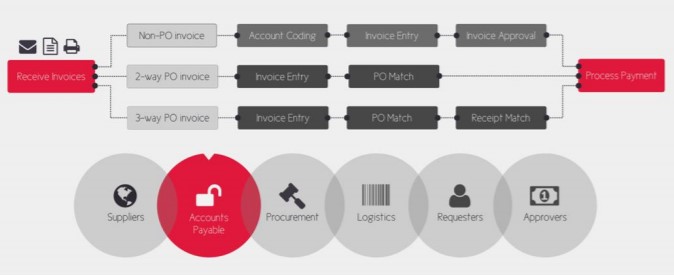

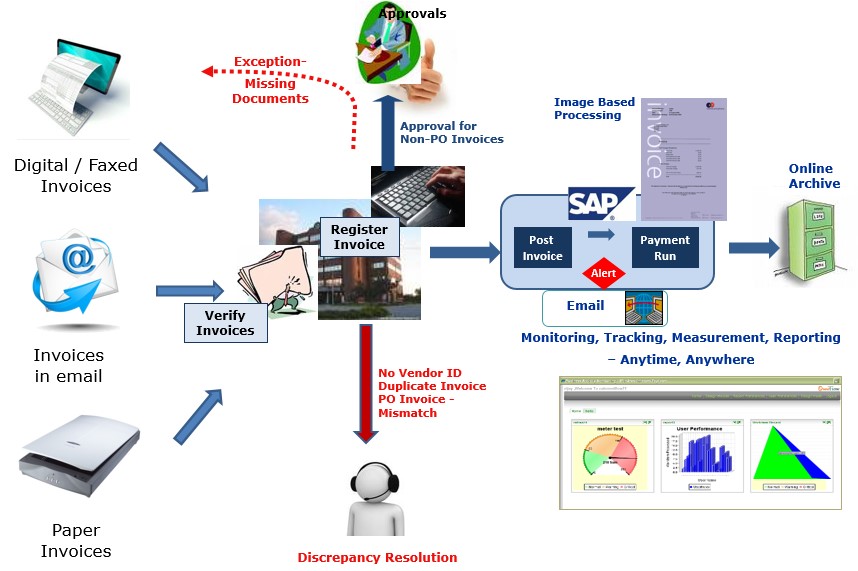

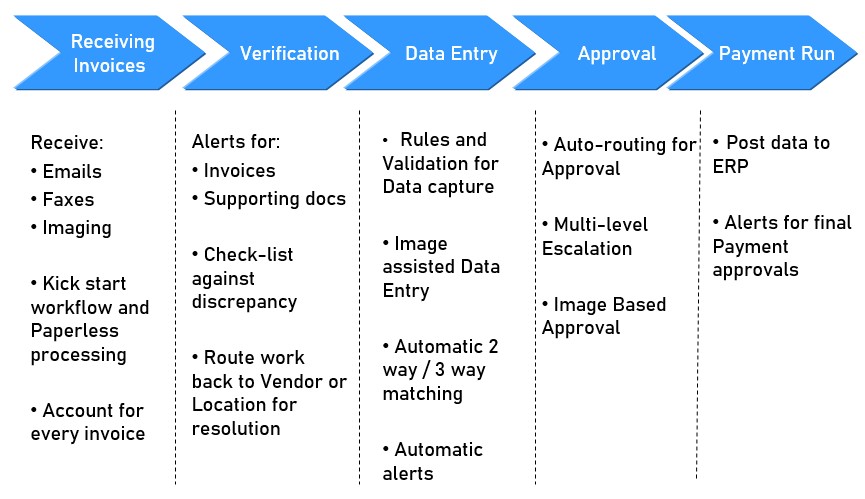

Most organizations receive invoices via many channels including mail, fax, e-mail, and EDI. Some of these invoices are already in electronic form. However, most arrive as paper documents that must be entered into the financial system, routed for approvals, matched against purchase orders or coded to GL accounts, and filed. No matter how these invoices are received, typical AP processes include a familiar series of steps: capture the invoice, manually rekey the data, code the invoice against purchase orders or GL accounts, route the invoice for approval, and issue payments against the invoice. This basic cycle is illustrated below.

Automating Accounts Payable using Newgen’s Procure to Pay (P2P) Suite

AP departments can work smarter by relying on automated capture, imaging, and workflow technologies to streamline repetitive, time-consuming tasks. You can remove paper from this multistep process by electronically capturing the documents, converting them into images, and creating workflows to govern the approval lifecycle and integrate the data with your enterprise systems of record.

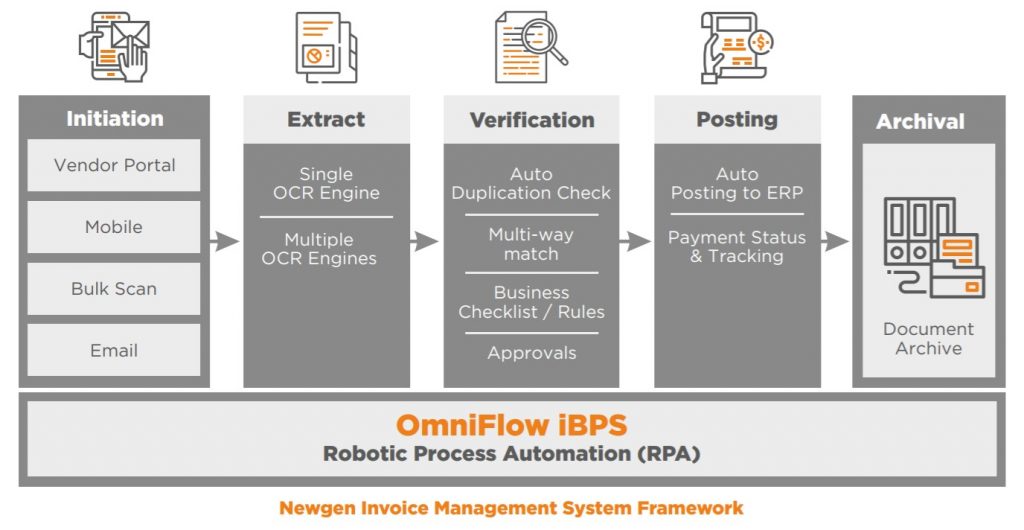

Built on a robust BPM platform – OmniFlow iBPS, the solution binds together purchasing and accounts payable department, enabling stakeholders to collaborate in a seamless manner. Leveraging the solution, financial leaders gain a centralized view of the entire department and make informed decisions.

The solution notifies users about task initiation, completion, reassignment, decline and failure through a system generated email. It allows users to accept/reject/reassign a task to other users in line. Further, it enhances performance by automating actions such as assigning a value to a variable, making a task mandatory/optional and others. All the documents captured during the process are archived in the solution’s built-in document repository for easy access in the future.

Know more about digital transformation solutions from Newgen, the global leader in Business Process Management & Enterprise Content Management.

Newgen’s P2P solution is adept at handling end-to-end processes through its dynamic and workflow-driven environment. The solution enables organizations to eliminate paper-driven procurement processes and streamline the complete cycle, from start to finish.

Newgen’s P2P solution is backed by various peripheral technologies, namely Robotic Process Automation (RPA), Mobility, and Analytics to help financial leaders manage processes smoothly.

Let’s have a look at each of the above offerings in detail and how Newgen can support in delivering your digital transformation agenda.

Purchase Request Management Solution

It helps organizations eliminate manual processing of purchase requests (PRs). Using the solution, users don’t have to circulate physical forms from one desk to the other for approval. It allows for direct submission of goods and services purchase orders. The PRs are then auto-routed to managers for final approval. Key highlights are –

- Easy approval/ rejection, exception and query management

- Multi-level tasks escalations

- Complete requests tracking

- Integration with disparate systems to eliminate re-key of information

Vendor Onboarding Management Solution

The solution enables organizations to onboard vendors in a hassle-free manner and save significant process cycle times. Using the solution, vendors can initiate requests by filling the onboarding form. Based on pre-defined rules, the forms are verified and approved. Further, a unique vendor code is generated for users to make remittance in a convenient manner. Key highlights are –

- Email alerts and notifications for transactions, approval and reworks

- Complete tracking of requests

- Anytime-anywhere accessibility

- Email triggers with complete details of a transaction for approval and reworks

Purchase Order Creation Solution

It enables users from the procurement department to gain access to open and approved requisitions. With a single click, users can initiate requests for new requisitions, submit supporting documents, and share those cases with the next set of users in line for approval. Key highlights are:

- Filter PRs based on purchasing group, delivery location, vendors and others

- Intelligent purchase requisition consolidation

- Auto-validation and checks for duplicity in data, budget, and vendors’ contracts

- Quick purchase order preview

Invoice Management Solution

It enables businesses to optimize the lifecycle of invoices. Leveraging the solution, organizations can gain complete visibility of invoices and their status. Further, business leaders can manage their organization’s cash flow and give a solid forecast based on accurate data. Key highlights are:

- Multi-channel initiation

- Duplicate invoice checker

- Intelligent extraction

- Case routing

- Integration with vendor portal

- Auto-validation & verification

- Secure archival

Vendor Portal Management Solution

This solution expedites, standardizes, and streamlines vendor data & documentation in a seamless manner. Vendors can register and submit their supporting documents, while finance team can monitor the complete process and avoid oversights. The solution is tightly coupled with workflow systems, offering the status of invoices to vendors in real-time. Key highlights are:

- Invoice submission

- Query submission and resolution

- Comprehensive report generation

- Instant alerts and notifications

- Integrations with ERP systems

Contract Lifecycle Management

The solution standardizes, streamlines and automates complete contract lifecycle, from initiation, creation, negotiation, execution expiration to archival. All contracts are centrally stored and can be easily reviewed during audits. Key highlights are:

- Library of clauses and contract templates

- Easy integrations with ERPs and CRMs

- Archival of contracts as per the organization’s retention schedule/policies

Payment Processing Solution

It automates end-to-end activities, required prior to releasing vendor payments. Some of the activities are categorizing the vendor’s payment as per the due date, creating a proposal, getting the approval for proposals and payment release and remittance document sharing. Key highlights are:

- Due date/ payment reminders

- Multiple payment proposals approval as per date of agreement

- On-the-go accessibility

- Archival of remittance documents with invoices in a centralized repository

- Auto-alerts & notifications to vendors on payments release

Master Data Management Solution

The solution streamlines the complete process and enables users to access timely and relevant data while analyzing trends, opportunities, and organizational performance. Key highlights are:

- Communication routing to the right user at the right time

- Checklist & exception management

- Centralized and web-based audit facility

TOP Benefits and Savings with automating Accounts Payable

- Better insight in expenditure, resulting in a better negotiation position and better contracts.

Savings: 4% – 7% of additional influenceable expenditure - A central order-to-pay process, resulting in improved compliance.

Savings: 2.5% – 5% of additional influenceable expenditure - An automated P2P process, resulting in reduction of invoice processing time (3 to 4 days).

Savings: 0.3% – 2% of additional influenceable expenditure - An automated P2P process, resulting in better risk insights and better (annual) reports.

Savings: 2% – 5% of accountancy fees - Improved and automated invoice processing, resulting in increased efficiency when meeting payment obligations.

Savings: Up to 50% reduction in Full-time Equivalents (FTEs) of Employees

Here’s Why Automating Accounts Payable is a No-Brainer

A digital business strategy creates value and revenue from digital assets by forging connections among AP departments are motivated to simplify the tedious cycle of processing invoices, from initial receipt to final payment. Automating invoice processing reduces reliance on paper forms, faxes, and documents. It also enables you to take advantage of dynamic discounting, accelerate payments, and eliminate late-payment fees. Finally, it gives finance officers greater visibility into liabilities, cash management, accruals, and financial close processes.

Reducing paper in financial processes can immediately impact your bottom line. By combining document capture and imaging technology with advanced workflow capabilities, you can empower AP users and other knowledge workers to manage unstructured, unpredictable processes in a simple and intuitive way.

Automated processes not only save paper and reduce courier costs—they also increase accuracy, helping to avoid costly errors and minimize risk. By correctly implementing and integrating these technologies, astute companies can reduce process cycle times by more than 50 percent and save valuable cash in operational costs.

Author