Blockchain is a technology that can allow authenticated data communication between each player in a supply chain without the intermediation of a trusted central organization. By verifying and adding data in real time, blockchain can increase transparency across a supply chain. According to Bank of England, a blockchain is “a technology that allows people who don’t know each other to trust a shared record of events.”

Blockchain is a digitally distributed ledger or database of records, transactions, or executed events that are shared across the participating parties. Each transaction in this system is time stamped and verified by a consensus of a majority of participants in the system.

A blockchain is made of a “chain” of information-storing “blocks,” where each block contains information such as transactions made, amounts, and parties involved. It is possible to access all previous blocks linked together in the chain, so a blockchain database retains the complete history of all the assets and instructions executed since the very first one.

This distributed verification method promotes data integrity and transparency, dubbing the technology as an enabler of “trustless trust,” meaning that parties don’t need to know or trust each other to participate in exchanges of value with absolute assurance and reputable intermediaries. Blockchain also does not have a central point of failure because all participants will have a copy of the ledger, making it more durable than a centralized system.

Strategic supply chain financing is crucial, determining your relationship with buyers and suppliers. However, the process is often slow, inefficient, and prone to errors due to excessive manual intervention. The need of the hour is to digitize the complete process while bringing transparency and improving traceability across the supply chain finance process.

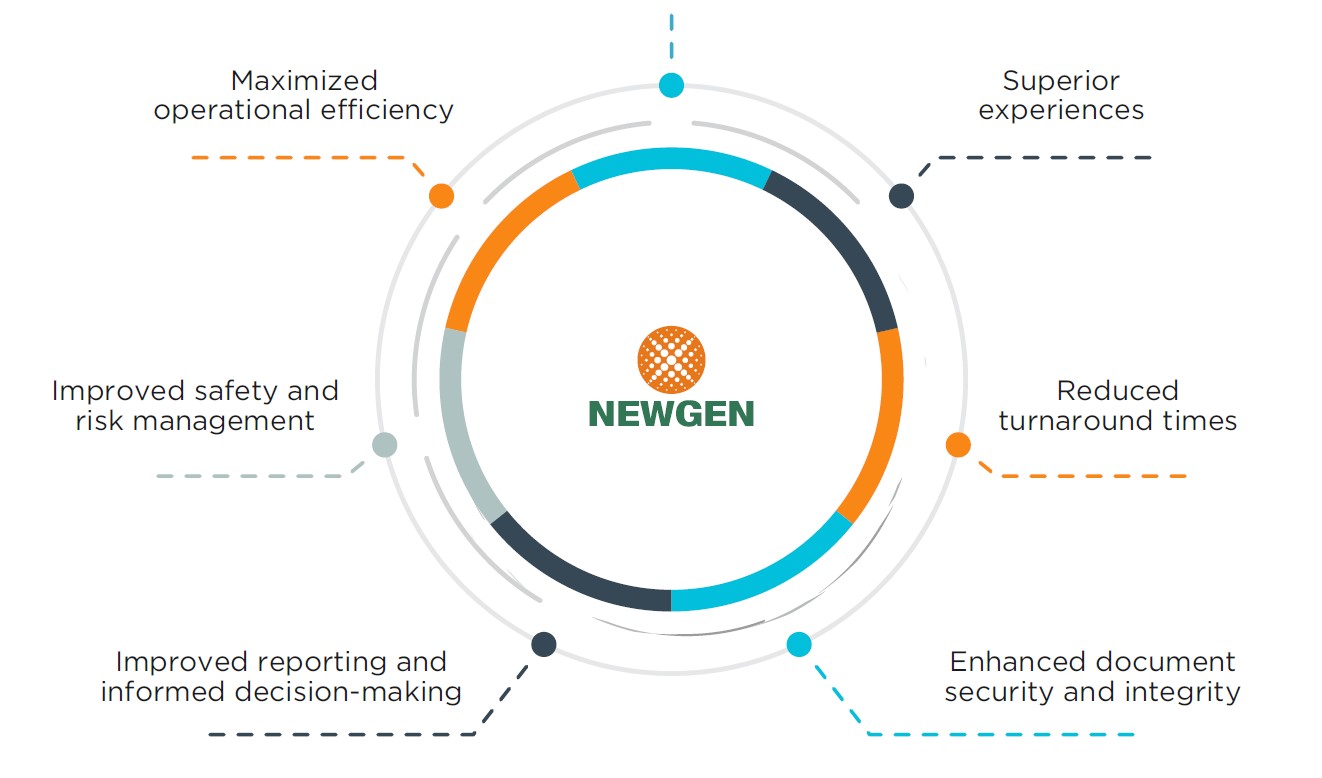

The Newgen Blockchain-enabled Supply Chain Finance Solution provides a holistic view of supply chain finance activities. By leveraging the solution, you can smoothly manage your working capital, increase liquidity, mitigate risks, and enhance operational efficiency.

What is Supply Chain Finance?

Supply Chain Finance (SCF) is a form of supplier finance in which suppliers can receive early payment on their invoices. Supply chain finance reduces the risk of supply chain disruption and enables both buyers and suppliers to optimize their working capital.

Supply Chain Finance from a technology standpoint can mean a set of technology-based business and financing processes that connect various parties involved in a transaction – buyer, seller, and financial institution – to minimize financing costs and improve business efficiency.

Here are the steps that’s involved in the Supply Chain Finance process:

- The supplier initiates the invoice of shipped/supplied goods or provided services for the buyer

- The supplier sends the invoice to the financial institution’s SCF platform

- The buyer approves the invoices using the same platform

- The financial institution releases the payment against the received invoice

- On invoice maturity, the financial institution debits the amount from the buyer’s account

Why Choose a Blockchain-enabled Solution for Supply Chain Financing?

A blockchain is a decentralized, distributed digital ledger, developed to record immutable transactions by keeping user identities classified. The immutable transactions steer through several computers, called nodes, without altering any subsequent blocks, allowing the participants to verify and audit transactions inexpensively.

Some of the key benefits of a Blockchain-enabled solution are as follows:

- Consensus based approvals

Reaches agreement among nodes and maintains a copy of the ledger to prevent single-point-of-failure.

- Trackability

Verifies the history, location, or application of a transaction by using recorded identification in the blockchain network.

- Immutability

Ensures every transaction that has reached consensus is time-stamped and cannot be altered.

- Untamperable

Secures every transaction by veiling the identity of the users and the transactions.

Newgen’s Blockchain-enabled Supply Chain Finance Solution

The Newgen Blockchain-enabled Supply Chain Finance Solution, built on a low code digital automation platform, provides you a secure way to manage the end-to-end process, from onboarding to final disbursal.

By leveraging the solution, you can gain visibility, increase efficiencies, and minimize costs throughout the chain. Furthermore, it helps you adopt a collaborative approach toward other parties in the chain.

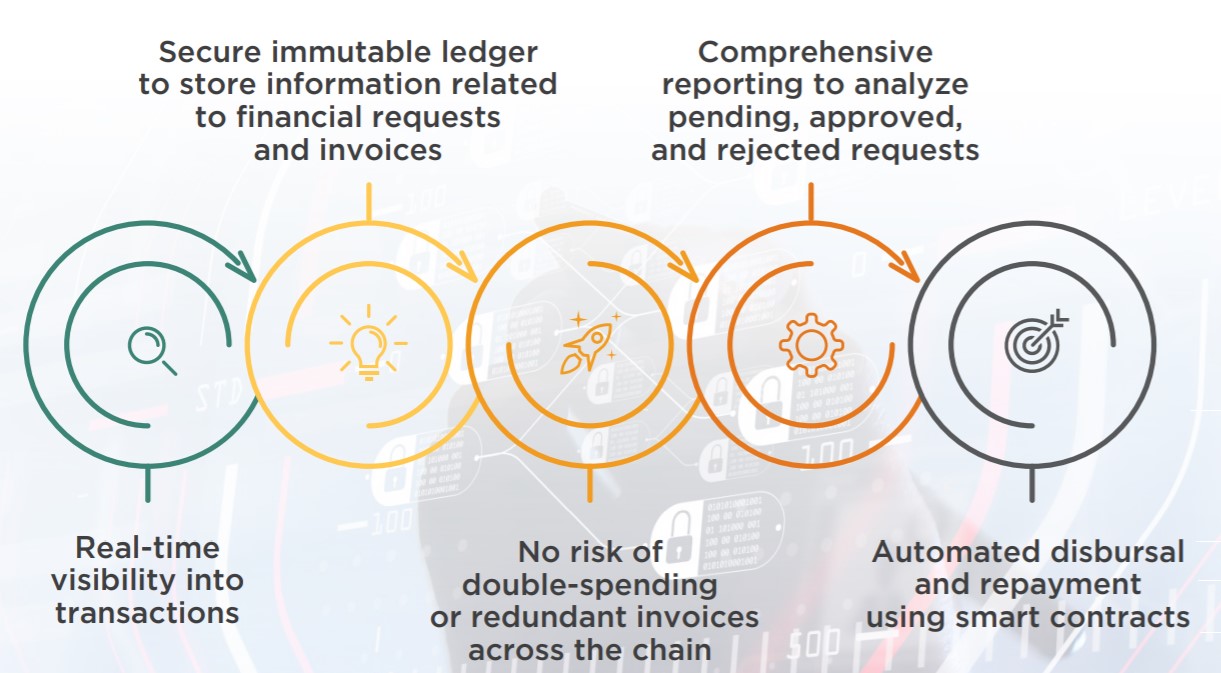

The key highlights of Newgen’s Blockchain-enabled Supply Chain Finance solution are as follows:

Audit Tracking

Enable traceability of information and documents as they move from one user to another, thereby keeping all the involved stakeholders on the same page and minimizing exposure to fraudulent activities and credit risks.

Utilize smart contracts while enabling all the involved parties in supply chain finance to work on a single, shared ledger.

Provide secure access for the financial institution to manage smart contracts while monitoring processes, including manufacturing, shipping, order fulfilment, etc.

Ensure 100% trust and transparency by using immutable ledger records; suppliers, manufacturers, and other participants can update their part of each transaction.

Invoice Tokenizing

Create and save hashes on the blockchain for each invoice, based on predefined parameters.

Ensure 100% data integrity; the solution does not have the provision to create duplicate copies of existing invoices.

Eliminate double-spending concerns and remove redundant invoices across the chain.

Invoice Settlement

Ensure quick settlement based on predefined rules for invoice and finance payment.

Detect outstanding invoices or finances from the buyer or seller.

Ensure reconciliation of outstanding invoices against the payment initiated by the buyer/seller without manual intervention.

Automate disbursal and repayment by a settlement utility.

Superior User Experience

Intuitive user interface to drill-down to multiple levels when viewing customer, product, and supply chain finance product key performance indicators.

Comprehensive dashboards for faster decision-making.

How the Blockchain-enabled Supply Chain Finance Solution Works?

By using the onboarding module, you can capture the personal and financial details of users.

Once the user is verified, they can securely access the portal.

The buyer/supplier can request the financial institution to finance an order, based on the request type (factoring or reverse factoring) and track the current state of the respective transaction.

Order details and finance details of the buyer/vendor are recorded as the request is initiated. All these details, including factory details, invoice details, etc., are captured on the blockchain, along with proper audit tracking.

Tokenization, implemented through blockchain, ensures no duplicate invoice is added in the system while eliminating double-spending.

The supplier can upload multiple invoices and GRNs while raising a request; the invoices are safely recorded in the system.

The uploaded documents can be viewed when a request reaches the next set of users in the approval process. The request is authorized by a checker using a digital signature and dedupe checks, thereby eliminating the chances of fraud and discrepancies.

Once the financial institution accepts the request, the auto-settlement utility disburses the funds.

Newgen’s Supply Chain Finance Solution Core Functionalities

Digitized Supply Chain Finance

Centralized processing of transactions with the convenient routing of role-based workflows.

Increased value delivery to corporate with the timely availability of transactional details for the finance team.

Counterparty Onboarding

Separate onboarding module to support corporate buyers and sellers.

Counterparty onboarding via a single, secure sign-on portal.

Instant capture of users’ personal and financial details, including limits, credit scores, and plans. Post verification, users can securely access the portal.

Integration with OmniDocs

Robust integration with Newgen’s OmniDocs Contextual Content Services (ECM) product suite to easily upload and access contextually accurate documents.

Upload of multiple invoices and goods receipt notes (GRNs).

Accessibility of documents and their recordings, related to a specific order request, purchase order, invoice, GRN type, etc.

Anti-fraud Risk Management

Dedupe checking to identify duplicate and fraudulent invoices.

Request authorization by checkers using digital signatures to avoid fraudulent activities and discrepancies.

Real-time credit limit management with robust analytical capabilities.

Program Parameters

Various checks at the counterparty level, including maximum/minimum financing percentage, maximum/minimum tenure, preferred disbursement mode, and settlement.

Additional checks for automatic financing, settlement, and acceptance of invoices.

Sanctioned and ad hoc limit checks for eligibility at anchor, program, and counterparty levels.

Invoice Management

Manual creation and upload of invoices, along with options to amend, cancel, and accept.

Auto-financing of invoices based on predefined parameters with instant amendment options.

Easy upload of scanned invoices.

Auto-financing of accepted invoices, based on set parameters.

Invoice status monitoring and real-time updates of users’ details.

Invoice Settlement

Quick settlement based on predefined rules for invoice and finance payment.

Instant detection of outstanding invoices or finances from the buyer or seller.

Reconciliation of outstanding invoices against the payment initiated by the buyer/seller without manual intervention.

Automated disbursal and repayment by a settlement utility.

Invoice status monitoring and real-time updates of users’ details.

The Newgen Advantage

Newgen’s low code automation platform enables you to deliver a consistent experience for a holistic customer journey across channels. It empowers your knowledge workers through automation and provides access to contextual information, freeing them from mundane tasks and enabling smarter decision-making. Further, it offers flexibility to allow ad-hoc routing and exception-handling without disrupting the intended outcome, compliance, and process adherence.

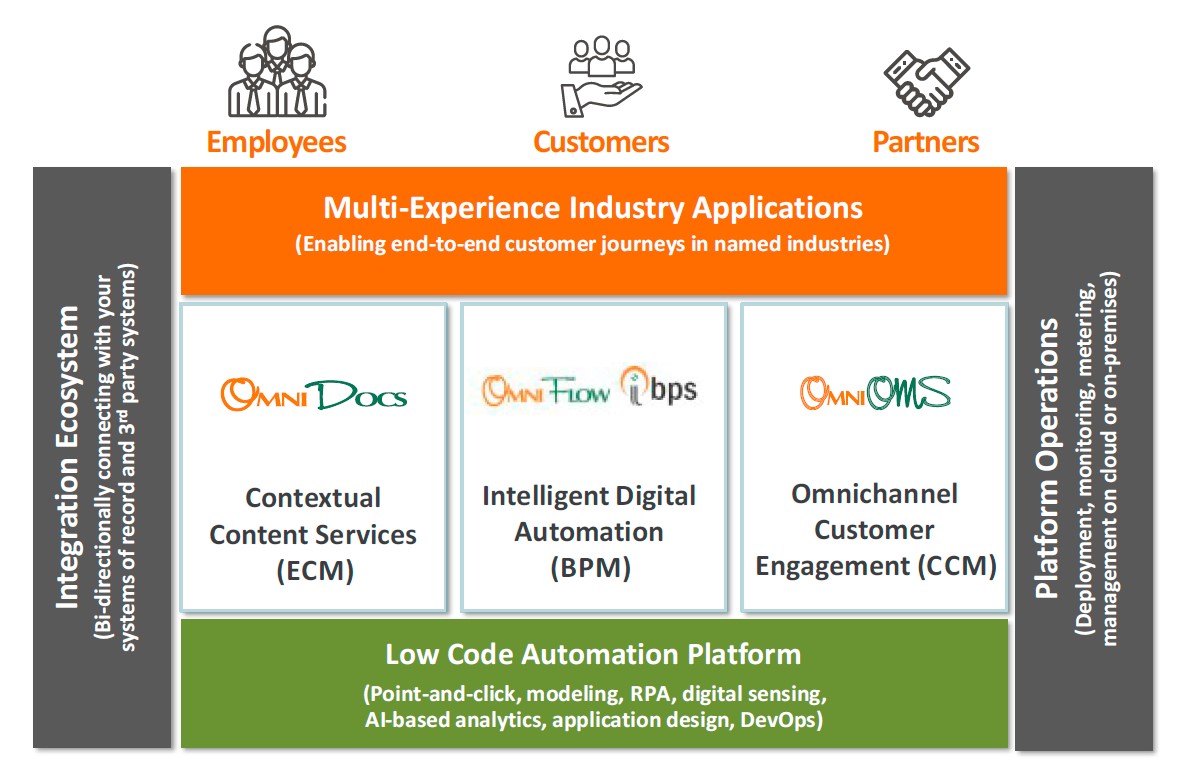

Newgen’s platform, with low code capability, integrates various capabilities needed to build business applications across the spectrum, through our proven products in intelligent digital automation (BPM), contextual content services (ECM), and omnichannel customer engagement (CCM).

Newgen offers a single platform that enables enterprise-wide request automation supporting simple as well as complex processes and delivers an omnichannel experience throughout your customers’ journeys.

The platform helps you transform experiences by bridging (process, content, and communication) silos in your organization. And, offers agility for sustainable and continuous improvement, thereby future-proofing your enterprise.

Further, the platform’s capabilities such as mobility, social, analytics, cloud, robotic process automation, blockchain, and artificial intelligence accelerate your digital journey and keep you ahead of the curve.

Author